QuickSweep, Offer, & List

ArtDEX offers shortcuts to traders looking to execute the most common transactions quickly. Our line-up of shortcuts:

1. QuickSweep#

You can use QuickSweep to quickly purchase the lowest priced items from a collection.

The ArtDEX interface will search across pools the lowest priced items and calculate the best deal for sweeping the floor.

This shortcut is useful for instant onboarding into an NFT project, especially if you think prices will go up soon.

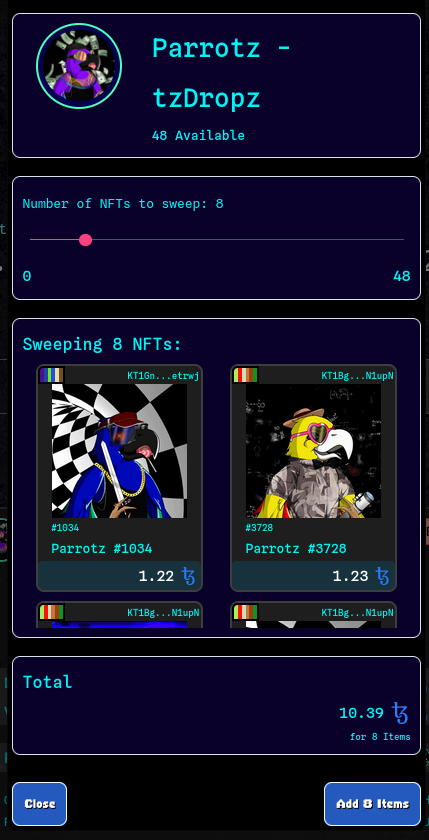

QuickSweep Usage#

Use the slider to select the number of NFTs you want, review the total, and click Add Items

Why use QuickSweep?#

On a classic NFT marketplace, sweeping the floor is not easy. With classic listing systems, most of the NFT liquidity will be concentrated around the floor price. This means that a sudden influx of users will create liquidity shortages at the new floor price, and interested users will have to wait for liquidity providers to relist NFTs at the correct price.

On ArtDEX, our persistent NFT liquidity reacts more quickly to market changes via bonding curves meaning liquidity providers can safely list more NFTs at the same time. This means that there is no need to wait for liquidity providers to relist assets in the event of a sudden price increase.

Thus, users can sweep NFTs faster on ArtDEX.

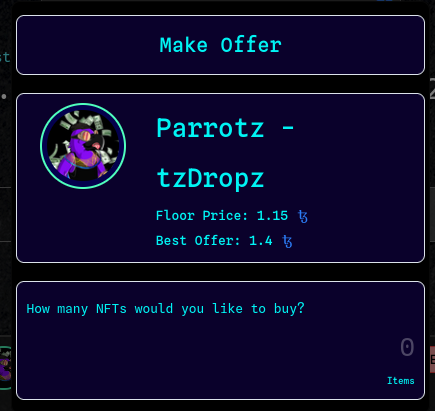

2. Collection Offer#

Collection Offer is a shortcut for quickly making a new one-way trading pool that purchases NFTs from other users.

If you have funds, but don't see your desired NFT collection trading on ArtDEX yet, this is a good way to get new NFTs.

tip

Collection Offers are ArtDEX pools, meaning a new contract will be deployed. We recommend making one Collection Offer and reusing it when needed.

caution

Since this is a one-way trading pool, you cannot set a User Fee.

Collection Offer Usage#

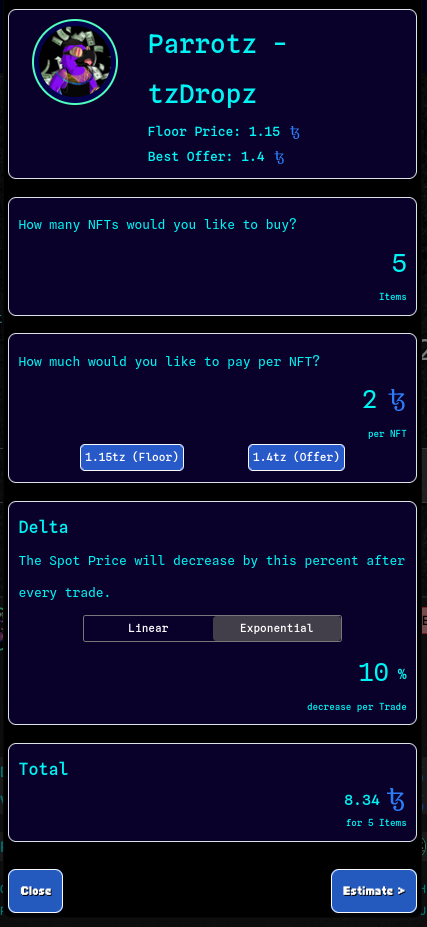

To use Collection Offer, input the number of items you want from this set.

Then, you'll chose the price you'd like to pay. Use the Floor Price to get your NFTs faster.

You may configure a delta, similar to the process in Create Pool section on parameters.

Your offer price will decrease according to the delta every time a user sells an NFT into your new pool.

When you've chosen your desired parameters, click or tap Estimate to review and deploy your pool.

Why use Collection Offers?#

You can use these offers as a type of NFT limit buy order.

For example: let's say you think the floor price of a collection will drop from 30 XTZ to 20 XTZ in the future. On a classic NFT marketplace, you'd create an offer for 20 XTZ.

The process on ArtDEX using pools is similar, you'd set the spot price at 20 XTZ and drop some XTZ in the reserves.

The difference with ArtDEX: you can configure a bonding curve & delta that will help your pool react to an even deeper price drop.

With a 5 XTZ linear delta, your pool would purchase at 20 XTZ then be able to buy the dip at 15 XTZ if there is a major crash in the floor price.

On a classic NFT marketplace, you'd have to manage multiple offers and be attentive at all times to get your limit order right.

With ArtDEX, it's easier.

3. List NFTs#

List NFTs is a shortcut for making a new one-way trading pool that sells NFTs to other users.

tip

Listings are ArtDEX pools, meaning a new contract will be deployed. We recommend making one Listing and reusing it when needed.

caution

Since this is a one-way trading pool, you cannot set a User Fee.

List NFTs Usage#

To use List NFTs, input the price you'd like other users to pay for your NFTs. Use the Best Offer to sell your NFTs faster.

You may configure a delta, similar to the process in Create Create Pool.

Your pool's price will increase according to the delta every time a user buys an NFT from your new pool.

When you've chosen your desired parameters, click or tap Estimate to review and deploy your pool.

Why use List NFTs?#

Listings can be used as an NFT limit sell order.

For example: let's say you think the floor price of a collection will increase from 20 XTZ to 30 XTZ in the future. On a classic NFT marketplace, you'd create an listing for 30 XTZ.

The process on ArtDEX using pools is similar, you'd set the spot price at 30 XTZ and drop your NFTs in the reserves.

The difference with ArtDEX: is that you can configure a bonding curve & delta that will help your pool react to even higher price increases.

With a 10 XTZ linear delta, your pool would sell NFTs at 30 XTZ then be able to sell even higher at 40 XTZ if there is a major pump in the floor price.

This is not an uncommon scene in the NFT space. NFT collections may have one big pump and never go up again. If your aim is to sell high, you'll want to provide liquidity that reacts to market changes.

On a classic NFT marketplace, you'd have to manage multiple offers and be attentive at all times to get your limit orders right.

With ArtDEX, it's easier.

--

Congratulations. You are now equipped with all the knowledge needed to efficiently trade and provide liquidity on ArtDEX!

Now, lets move into the advanced theory behind arbitrage on ArtDEX.